I’m often asked to give an opinion on the value of single-family homes. When the owner is the one asking, I assume they already have their own idea of what their house is worth. Unless we agree on what value means and which criteria I’ll use, there’s a good chance my answer won’t match their expectations. Typically, the only “right” answer is one that meets or exceeds their own opinion.

Humility comes from recognizing we don’t know everything, and that what we do know can change. When it comes to pricing a house, the best I can do is estimate a value that an appraiser—using the same data—might calculate for a mortgage lender. I cannot predict what a highly motivated buyer with deep pockets might offer to outbid everyone else. Instead, my approach is to analyze comparable sales data, just like an appraiser would.

This is how I approach the “What’s my house worth?” question.

I start with this premise: Your home is worth what at least one person is willing to pay, and you are willing to accept. If we agree on that, here’s the next one: Most buyers make offers close to what similar homes in the neighborhood have recently sold for. As long as we agree, we’re on the same page. The third premise is tougher: Sometimes, there’s a buyer who’s more motivated and financially able than the rest, willing to pay a premium to secure your house. This is the extraordinary buyer everyone hopes for—and everyone knows a story about. But while extraordinary buyers do sometimes outbid the crowd, most home sales involve typical buyers with typical means. If you price your home only for an extraordinary buyer, you eliminate competition and end up favoring that one buyer—who, ironically, then becomes just another typical buyer.

The Appraisal Method

Not every home sale involves a mortgage, but most do. When a mortgage is involved, there will usually be an appraisal. The appraisal’s outcome often determines whether the lender is willing to approve the loan the buyer needs to close. To confidently accept an offer that requires an appraisal, we need to know what price range the appraisal is likely to support. Because appraisal rules are clearly defined, we can use them to run the numbers and decide if we need protections in the offer before committing to sell on the buyer’s terms.

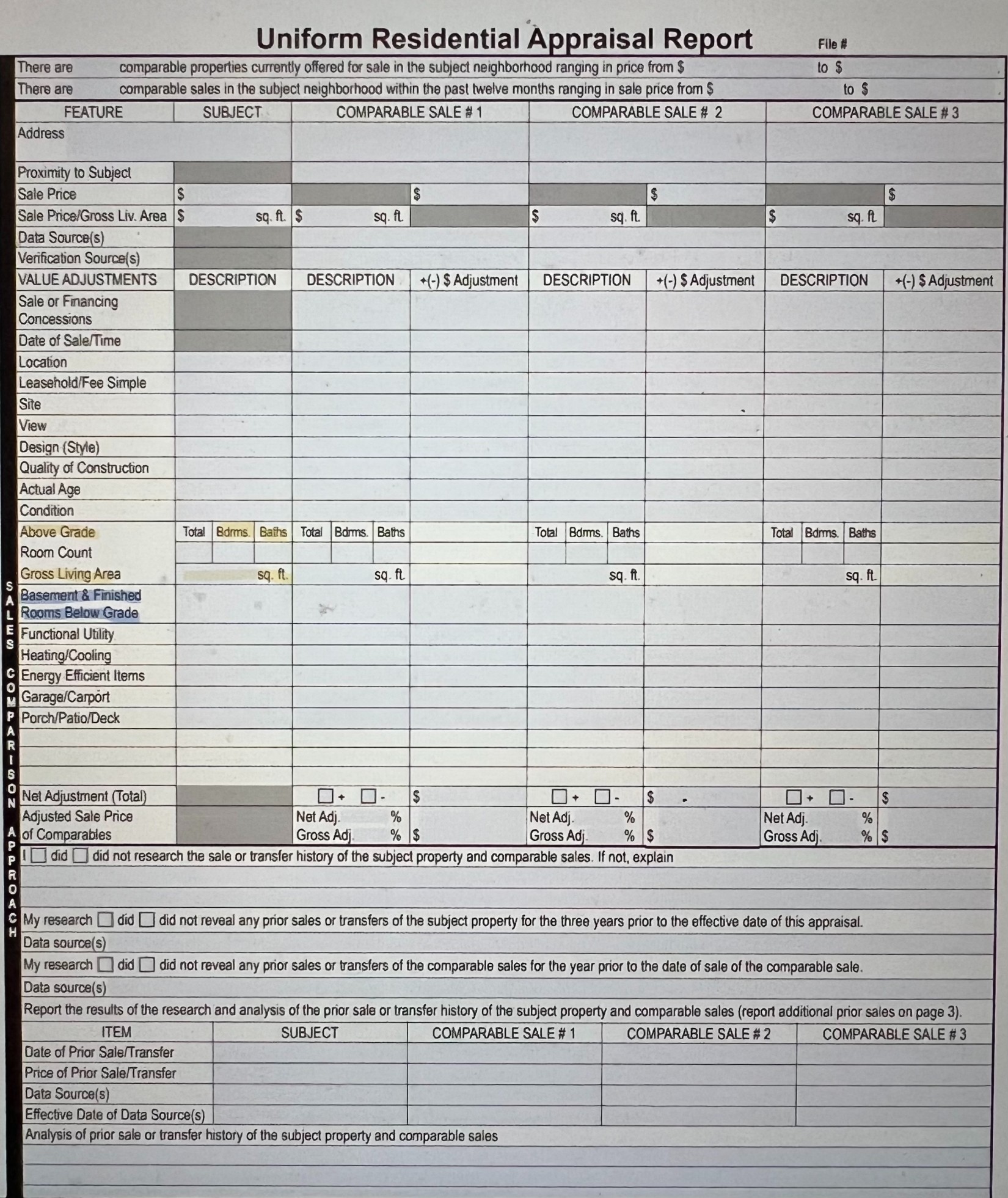

Page 2 of the Uniform Appraisal Report

The second page of the Uniform Appraisal Report (UAR) is where the appraiser calculates value. The rest of the report provides supporting details and market conditions. The key section is in the middle of page two. In appraisals, above-ground floors are valued most highly—they matter more than finished space in the basement.

For example, let’s say I have a two-story house with five bedrooms—three above ground and two in the basement. The main two floors have 2,400 square feet, and the finished basement adds 1,400 more. You recently sold your house, which has a main-floor bedroom and four bedrooms upstairs, for a total of 2,800 square feet above ground and 1,000 finished in the basement. According to appraisal standards, my house is considered a three-bedroom home with finished basement space, while yours is a five-bedroom home. Basements are typically valued at 50% to 75% of the price per square foot of above-ground space, so our finished basements might be worth about the same. The real difference is the main floor square footage: your main-floor bedrooms add more value to your home compared to mine. Appraisals don’t account for personal preferences—only measurable features.

Adjustments

Not all homes are built the same, even within a neighborhood. When appraisers compare houses, the appraisal form allows them to adjust values up or down for amenities that one home has and another lacks, based on recent sales in the area.

Appraisers may not use the same dollar values for adjustments, but they’re expected to keep those adjustments reasonable. Large, unusual adjustments—like adding $25,000 for a view of a lake that’s only visible from a bathroom—will raise red flags with underwriters. More reasonable adjustments might include deducting $5,000 if your home lacks a deck that a comparable property has.

Here’s the bottom line: Your appraised value will generally be the average price per square foot of three comparable sales, adjusted for amenities, plus a bit of subjective judgment from the appraiser.

This method isn’t perfect, and even mathematicians might argue it’s not the best. But it’s how lenders decide whether buyers can get a loan. Since I can’t reliably predict that an extraordinary buyer will appear, I recommend pricing your home in line with recent comparable sales—where most buyers will see the price as reasonable. If you do get an extraordinary offer, we can include protections in case the appraisal comes in lower than the sale price. If the offer matches our estimate, we can safely agree to terms that make the sale contingent on the appraisal result.

So if you ask me what you can sell your house for today, my honest answer is that I don’t know for sure—but I can show you what an appraiser might say it’s worth.